Contracting is becoming increasingly popular in the technology sector. There are many reasons behind this, but much of it is due to the ability to earn more and have a greater variety of work. Advances in technology have also made it easier to be a contractor, and there is a generational shift taking place where workers are less worried about work security or having a job for life. However, before you pack up your permanent job and set up your own company, there are a number of things you should take into consideration.

Contracting is becoming increasingly popular in the technology sector. There are many reasons behind this, but much of it is due to the ability to earn more and have a greater variety of work. Advances in technology have also made it easier to be a contractor, and there is a generational shift taking place where workers are less worried about work security or having a job for life. However, before you pack up your permanent job and set up your own company, there are a number of things you should take into consideration.

Types of Contractor

Contracting is a term that is used to describe someone who isn’t a permanent employee. Contractors are often confused for temporary workers, but the two are very different. This is because temporary workers are still effectively employees, with the employer taking care of all tax obligations including KiwiSaver.

Most technology contractors will only work for one or possibly two clients at a single time, however there are those who complete lots of concurrent projects. Generally these are referred to as freelancers.

Independent contractors can be engaged in two different ways, either as a sole trader or through a private company. For non resident contractors, the client is required to deduct withholding tax and remit to the Inland Revenue Department on your behalf (unless you hold a valid exemption certificate). Sole traders invoicing more than $60,000 in a 12 month period must register for and charge GST.

For the purpose of this article we are focused mainly on independent contractors, but many of the elements covered may also be relevant to temporary workers.

Financial

Generally speaking, as a contractor, you will earn more than a permanent employee. However, there is the added risk that you could be out of work for a period of time in-between assignments. You will also need to pay for your own professional indemnity and liability insurance, accident compensation, as well as pay someone to manage your GST and Tax.

Working through a recruitment agency such as RWA can help to mitigate some of these costs. For example, we have a fantastic track record of placing previous contractors straight into new assignments without any down time. Whilst you will likely still need an accountant, managing invoicing and the day to day tracking of your finances is now significantly easier than it was even five years ago, thanks to cloud software such as Xero or MYOB.

As a contractor you also need to be aware that if more than 80% of your income comes from one customer, you must declare all income as shareholder salary. This means that you cannot leave your income “in the business” in order to minimise tax obligations.

Although contractors earn more, they don’t receive sick, maternity, bereavement or statutory leave, or holiday pay. This means the annual 31 paid days off you’ve previously looked forward to become less enticing, because you aren’t earning any income. You will also need to plan for your own retirement. As you won’t be making KiwiSaver contributions from your PAYE, KiwiSaver contributions need to be paid directly to your provider.

Risk

The current positive technology employment market means there is a lot of work available, meaning that contractors shouldn’t go too long without an assignment. However, should this change, contractors will be the first group to be effected. This is because it is significantly easier for a contractor to be released from an assignment with minimal notice and no specific reason, due to the employer not having to navigate employment legislation in relation to independent contractors. This is somewhat combated by the knowledge that as a contractor you will be used to moving companies, and will know how to quickly adapt to a new environment if needed.

Tax legislation is also another risk to consider, as a contractor, if you work exclusively for the same client for more than a year, there is a risk you could be deemed by the IRD to be an employee. The IRD’s definition of an independent contractor and employee can be found here.

Lastly, if the end client were to encounter financial difficulties and cease to trade, as a contractor you would become another creditor whose payment for work completed isn’t guaranteed.

Training & Culture

Most employers invest in employees to help them better their career. This could be in the form of on the job training, classroom learning or conferences. As a contractor, the responsibility for learning is with you, therefore the cost of conferences and any training must be taken into account.

Contractors are becoming more accepted as part of the workforce, but you may find it that in some environments you will miss out on activities that are standard for a permanent employee, such as Christmas parties, company events, and incentives and bonuses.

Opportunities

Although being a contractor comes with some risks, and is definitely more effort than working as a regular employee, it also comes with some great rewards and opportunities. As discussed, your pay will generally be higher as a contractor, but the freedom to take assignments when you please is also a big draw card.

Contracting can also present you with opportunities that you may not have encountered as a permanent employee. Take one of our contractors, Debbie Armstrong, for example. After contracting for the past 15 years, Debbie took up a role at Fletcher Construction as a Business Analyst. In this role, Debbie visited seven Pacific Island nations in just two months, analysing their current IT systems and assessing the level of support they would need to transition to a new one. You can find more about Debbie’s journey through the Pacific here.

Paul Brady is another RWA contractor who has had a great experience outside of the permanent workforce. After falling into contracting by accident, Paul has worked with Air New Zealand for the past five years and has been able to contribute to some massive projects along the way. The flexibility of contracting was a big attraction for Paul, and he feels he has learned a lot as a contractor. “I think as a contractor you’re always more open to change” Paul says, “I think you become much more adaptable. I’ve learned a lot of skills going through a lot of organisations and being able to hit the ground running.” You can find out more about Paul’s work as a contractor here.

Ready to Take the Plunge?

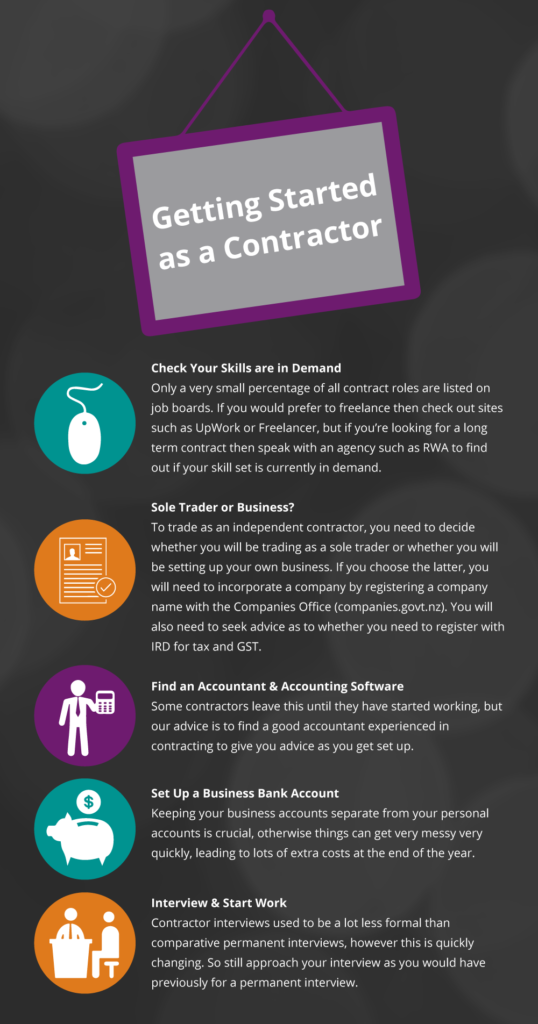

If you’ve read all of this and feel you’re ready to take the plunge, then great. Here is what you should do:

Summary

If you’re thinking about contracting and would like further information, then please feel free to get in touch, we would love to help. If you’re an employer looking to engage contractors, keep an eye out for our next blog, where we’ll go over the benefits and risks of hiring a contractor.

Good summary, after being out of contracting for a while it is interesting to note some new points regarding the IRD

Thanks Michelle, glad you found it helpful.

Thanks for sharing. I’ve just started being an independent contractor 2 months ago, with the information and tips, I can be more guided.?